Are Gold IRAs an Excellent Idea? A Twinkle of Wide range or Fool’s Gold?

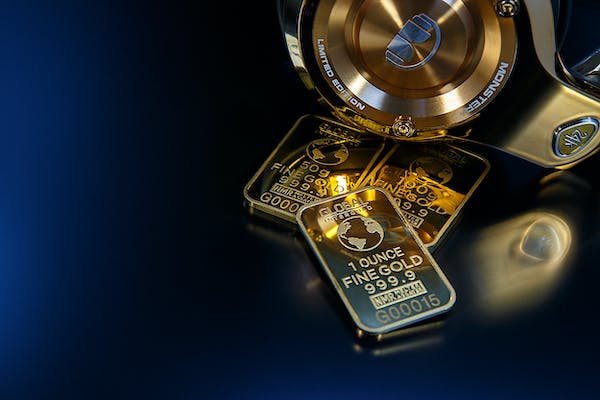

As the golden of our working years approaches, the appeal of securing our future with concrete assets like gold escalates. Enter the world of Gold IRA Reviews, guaranteeing a place of security and rising cost of living defense among market volatility. Yet prior to diving right into this glittering landscape, a vital question emerges: Are Gold IRAs a great concept? In this detailed review, we’ll peel back the layers of gold’s mystique to discover its potential value and hidden mistakes, empowering you to make enlightened decisions for your golden years.

The Attraction of Gold IRAs: Beaming Assures in Uncertain Times

Gold IRAs offer several potential benefits:

- Rising Cost Of Living Hedge: Gold historically maintains its worth throughout periods of rising cost of living, possibly protecting your retired life savings from rising rates.

- Portfolio Diversification: Including gold to your profile can lower its overall danger by supplying a counterbalance to supplies and bonds that may vary dramatically.

- Concrete Safety and security: Unlike paper possessions, physical gold offers a feeling of tangible safety and security and control, appealing to those seeking a hedge against economic uncertainty.

- Tax Advantages: Contributions to a Gold IRA can be tax-deductible, and potential growth within the account can be tax-deferred up until withdrawal.

Past the Twinkle: Shadows Lurking in the Gold Thrill

In spite of their attraction, Gold IRAs feature potential drawbacks:

- Limited Development: Gold traditionally supplies lower returns compared to other asset classes like stocks. This could impede your retirement portfolio’s long-term development capacity.

- Storage Space and Insurance Policy Costs: Owning physical gold incurs extra expenses for protected storage space and insurance, deteriorating your returns additionally.

- Liquidity Problems: Selling gold within your individual retirement account can be less convenient and have greater transaction expenses contrasted to other possessions.

- Fees and Markups: Gold individual retirement account companies often bill markups on the gold rate and extra costs for rollovers, transactions, and account maintenance.

Demystifying the Numbers: Revealing truth Price of Gold IRAs

Comprehending the covert costs is essential before embarking on your Gold individual retirement account journey:

- Markups: These can range from 5% to 10% over the gold spot rate, dramatically impacting your initial investment.

- Storage Space Charges: Expect yearly charges beginning around $85 for safe and secure storage of your gold, with boost based on the quantity and sort of steels held.

- Insurance Coverage Charges: Comprehensive insurance against loss or damage normally ranges from 0.5% to 1% of the gold’s complete worth every year.

- Added Fees: Bear in mind potential rollover charges, transaction charges, and account upkeep charges that can additionally deteriorate your returns.

Beyond Gold: Checking Out Different Courses to Retired Life Security

While Gold IRAs can supply diversity and potential protection, consider these alternative choices:

Typical IRAs and Roth IRAs: These supply a broader series of investment choices, possibly resulting in higher lasting returns.

Mutual Funds and ETFs: Gain diversified direct exposure to different property classes with reduced affiliated costs compared to Gold IRAs.

Property: Purchasing residential property can provide stable rental earnings and possible long-lasting recognition.

Seeking Specialist Assistance: A Beacon in the Maze of Choices

Consulting a certified economic expert is crucial prior to starting any kind of financial investment, including Gold IRAs. They can:

Evaluate your economic scenario and risk tolerance to establish if a Gold IRA is suitable for you.

Contrast and contrast various options like traditional Individual retirement accounts, Gold IRAs, and various other financial investment automobiles.

Aid navigate the complexities of costs and expenses related to Gold IRAs.

Create a varied and lasting retirement aligned with your distinct financial objectives.

ase Studies of Real-Life Gold Individual Retirement Account Experiences

To further browse the maze of Gold IRAs, allow’s look into the experiences of individuals who have selected this course. Their stories, both favorable and cautionary, can shed light on the practical realities of buying gold:

Case Study 1: The Careful Diversifier:

Sarah, 55: With a varied portfolio already in position, Sarah selected a small Gold IRA financial investment as a bush versus inflation. She meticulously researched companies, comparison-shopped for the most affordable markups and charges, and focused on protected storage and insurance coverage. Her experience: “Gold offers satisfaction understanding I have a concrete property throughout unclear times. However, I would not consider it a key financial investment avenue.”

Case Study 2: The Liquidity Issue:

Mark, 62: Dealing with an unexpected medical expense, Mark needed to access his Gold individual retirement account funds rapidly. While he valued the inflation security, the liquidity restrictions proved difficult. He faced higher deal costs and a lengthy marketing process, considerably impacting the offered funds. His experience: “Gold IRAs offer protection, but accessing your cash can be more difficult than prepared for.”

Study 3: The Hostile Sales Methods:

Susan, 60: Enticed by a salesperson’s promises of high returns, Susan spent a significant section of her retired life financial savings in a Gold IRA. Later on, she recognized the high markups and surprise costs considerably deteriorated her first investment. Her experience: “Be wary of aggressive sales strategies. Do your research and comprehend the full expense before dedicating to any Gold IRA.”

These diverse case studies highlight the significance of:

- Customizing your method: Customize your Gold individual retirement account investment to your specific financial goals and take the chance of tolerance. Do not blindly comply with the experiences of others.

- Prioritizing research and due persistance: Extensively study various service providers, contrast expenses, and comprehend all associated charges prior to dedicating.

- Seeking expert guidance: Get in touch with a competent monetary expert to guarantee a Gold IRA aligns with your overall retirement and danger account.

Beyond the Gold Standard: Final Thought and a Contact Us To Action

While Gold IRAs use a distinct financial investment option, they are not generally appropriate for every person. Remember:

Diversification is crucial: Gold can be an important asset, however don’t forget various other financial investment opportunities. Build a balanced portfolio with direct exposure to various property courses.

Knowledge is power: Enlighten on your own about Gold IRAs, linked prices, and prospective dangers prior to making any type of decisions.

Look for professional advice: A professional financial consultant can help you browse the intricacies of Gold IRAs and ensure they line up with your general financial goals.

By approaching Gold IRAs with a discerning eye, focusing on informed choices, and seeking expert advice, you can transform their possible into a safe house for your retired life financial savings, brightening your golden years with the knowledge of financial safety and assurance.